Michigan Property Tax Rate By City .to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691.

from taxfoundation.org

The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property. Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691.

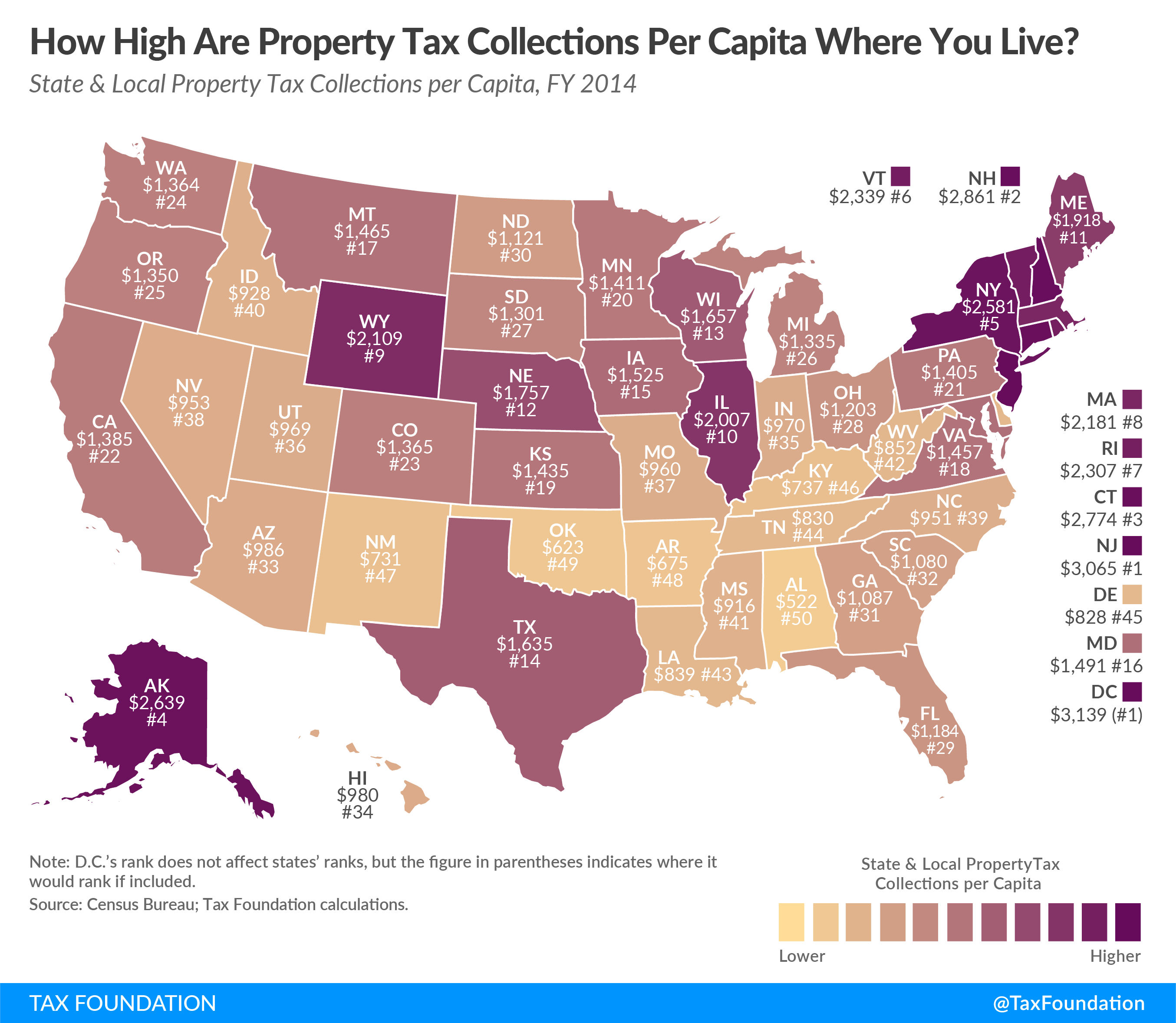

How High Are Property Tax Collections Where You Live? Tax Foundation

Michigan Property Tax Rate By City The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property. The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property.2022 total property tax rates in michigan total millage industrial personal (ipp) county: Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691.

From thebestframingnailer.blogspot.com

michigan property tax rates by township Massive EJournal Photography Michigan Property Tax Rate By City The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691.you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Estimate your property. Michigan Property Tax Rate By City.

From www.michigancapitolconfidential.com

Property Tax Revenue On a Slow Rise Michigan Capitol Confidential Michigan Property Tax Rate By City Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property.you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Michigan general property tax act. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691. The property assessment system is the basis. Michigan Property Tax Rate By City.

From wisevoter.com

Property Taxes by State 2023 Wisevoter Michigan Property Tax Rate By City Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691.property tax estimator and millage rates.you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Michigan general property tax act. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691. Michigan Property Tax Rate By City.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Michigan Property Tax Rate By City Michigan general property tax act. 2023 property tax and equalization calendar.2023 total property tax rates in michigan total millage industrial personal (ipp) county: Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691. Michigan Property Tax Rate By City.

From omaha.com

The cities with the highest (and lowest) property taxes Michigan Property Tax Rate By City2023 total property tax rates in michigan total millage industrial personal (ipp) county: Michigan general property tax act. Estimate your property taxes / millage rate information. Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property. Simply select the county, city/ township/ village and school district from the dropdown by clicking the search. Michigan Property Tax Rate By City.

From galaxysi9000amazon.blogspot.com

mi property tax rates Walker Galvez Michigan Property Tax Rate By City Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691. The property assessment system is the basis. 2023 property tax and equalization calendar. Michigan general property tax act. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691. Michigan Property Tax Rate By City.

From investoften.com

Property Tax Rates by State Where Does Your State Rank? Michigan Property Tax Rate By City Estimate your property taxes / millage rate information. Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property. Simply select the county, city/ township/ village and school district from the dropdown by clicking the search.to calculate the exact amount of property tax you will owe requires your property's assessed value and the. Michigan Property Tax Rate By City.

From www.cleveland.com

Find out where your city or township ranks for property tax rates in Michigan Property Tax Rate By City Michigan general property tax act.you can now access estimates on property taxes by local unit and school district, using 2022 millage rates.2022 total property tax rates in michigan total millage industrial personal (ipp) county: The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as. Michigan Property Tax Rate By City.

From midnite-fighter.blogspot.com

michigan property tax rates by township Lead Bloggers Ajax Michigan Property Tax Rate By Cityyou can now access estimates on property taxes by local unit and school district, using 2022 millage rates.to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Estimate your property taxes / millage rate information. 2023 property tax and equalization calendar. Web. Michigan Property Tax Rate By City.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Michigan Property Tax Rate By Cityproperty tax estimator and millage rates.to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's.2022 total property tax rates in michigan total millage industrial personal (ipp) county: The property assessment system is the basis. The millage rate database and property. Michigan Property Tax Rate By City.

From www.researchgate.net

Statewide Average Property tax Millage Rates in Michigan, 19902008 Michigan Property Tax Rate By City Michigan general property tax act.property tax estimator and millage rates. 2023 property tax and equalization calendar. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691. Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property. Michigan Property Tax Rate By City.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP Michigan Property Tax Rate By City Simply select the county, city/ township/ village and school district from the dropdown by clicking the search. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691.property tax estimator and millage rates.2023 total property tax rates in michigan total millage industrial personal (ipp) county: The millage rate database and property tax estimator allows. Michigan Property Tax Rate By City.

From www.mlive.com

Compare size of 2018 property tax bases in Michigan cities, townships Michigan Property Tax Rate By City Estimate your property taxes / millage rate information. Simply select the county, city/ township/ village and school district from the dropdown by clicking the search.to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Michigan general property tax act.2023 total property. Michigan Property Tax Rate By City.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Michigan Property Tax Rate By City2022 total property tax rates in michigan total millage industrial personal (ipp) county: The property assessment system is the basis. Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property. Michigan general property tax act. Simply select the county, city/ township/ village and school district from the dropdown by clicking the search. Michigan Property Tax Rate By City.

From onegeeksview.blogspot.com

michigan property tax rates by county Items EZine Picture Gallery Michigan Property Tax Rate By City Detroit had a total taxable value of $6,113,711,044 in 2018, of which 35% is residential property. Alcona alcona twp 011010 alcona community sch 20.4691 38.4691 14.4691 26.4691 20.4691 38.4691. Michigan general property tax act. The property assessment system is the basis.to calculate the exact amount of property tax you will owe requires your property's assessed value and the. Michigan Property Tax Rate By City.

From realestatestore.me

2018 Property Taxes The Real Estate Store Michigan Property Tax Rate By Cityproperty tax estimator and millage rates. 2023 property tax and equalization calendar. Simply select the county, city/ township/ village and school district from the dropdown by clicking the search. The property assessment system is the basis.you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Michigan Property Tax Rate By City.

From www.mlive.com

50 communities with Michigan's highest propertytax rates Michigan Property Tax Rate By City The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property. Simply select the county, city/ township/ village and school district from the dropdown by clicking the search.property tax estimator and millage rates. Detroit had a total taxable value of $6,113,711,044 in 2018, of. Michigan Property Tax Rate By City.

From prorfety.blogspot.com

Property Tax Rates By State Ranking PRORFETY Michigan Property Tax Rate By City Simply select the county, city/ township/ village and school district from the dropdown by clicking the search. 2023 property tax and equalization calendar.2022 total property tax rates in michigan total millage industrial personal (ipp) county:property tax estimator and millage rates. The millage rate database and property tax estimator allows individual and business taxpayers to estimate their. Michigan Property Tax Rate By City.